Most everyone wants to be a millionaire, or at least live comfortably and not stress over money. About a month ago I fell under the category of wanting financial freedom, but not knowing any strategies to achieve it. Financial freedom is when you have reached a point that you are living off of the interest your investments payout. I have researched the topic and have a few things to share.

- Make a spreadsheet or somehow visualize your spending. It will put things into perspective.

- Set goals… realistic goals

- Listen to podcasts or read about the topic. Listening to success stories and strategies can help keep you excited about saving money.

- Start early with your retirement.

- Do not give up! Don’t let a small slip up, or unexpected expense get you down.

There are numerous ways to visualize your spending, but here is one that I find to be useful. The file incorporates your spending and investments (retirement) to visualize when your income from your investments exceeds your spending (a.k.a. Financial Freedom).

Goals are tough to set and even tougher to achieve. Setting big goals seems smart because you are setting the bar high, but more often than not a person does not meet the big goal and is discouraged from continuing on. Realistic goals have less of an impact, but will encourage you as each is achieved. A good example of a realistic goal is setting a maximum weekly dollar amount that you will spend on food, or going out. This should be somewhere in the 5%-10% range for most people trying to save. I personally use You Need A Budget (YNAB) to track my goals, which costs $7 a month to have. There are many free options as well, such as mint. Both YNAB and mint have apps and websites for easy access.

Podcasts are a great way to learn new savings/investing strategies, along with keeping you excited about achieving financial freedom. I recommend Planet Money and Money for the Rest of Us.

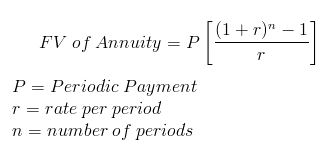

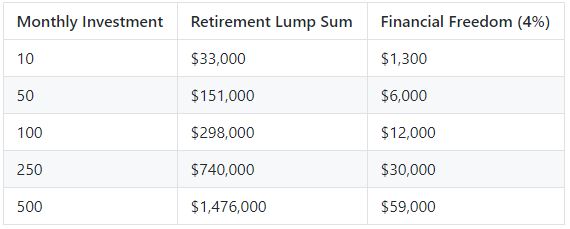

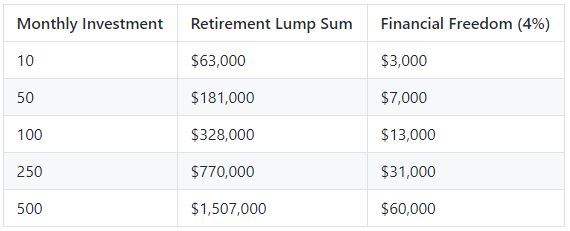

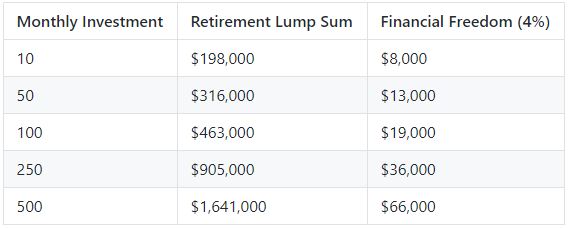

Starting your retirement early is like rolling a snowball down a snowy hill. The bigger the snowball is at the beginning the exponentially bigger it will be at the bottom of the hill. Similarly, the more you invest in your 20s the exponentially more you will have when you retire. The tables below show various monthly investments at different interest rates to visualize the compounding interest effect. The payout is shown as a lump sum and a dividend at 4% interest to show the full amount along with how much you can spend yearly without depleting your money. The dividend at 4% interest represents financial freedom, because you would be living off of the money made through interest. A 35 year career length and an interest rate of 10% are assumed. The equation is shown below, in the case that you would like to plug your own numbers in.

Equation for Future Value of Annuity

Investing $10 a month the first year

Investing $100 a month the first year

Investing $500 a month the first year

The end result is that when you invest $490 more per month ($5,900 per year) during the first year that you are working, then you will have $580 more per month ($7,000 per year) to spend for the rest of your life post-retirement. As you can see, the amount you save has an even larger impact on your retirement as well.

The last tip is to not be discouraged when “life” hits you. Many months will be in the red, but anything you can save is better than saving none.