Research Question:

What is the effect of the KYTC scholarship on a student after they graduate from school and begin working?

KYTC Scholarship Background

The Kentucky Transportation Cabinet Civil Engineering Scholarship Program began in 1948. There are roughly 80 scholarship students in the program at any given time. Students who are attending or planning to attend the University of Kentucky (UK), Western Kentucky University (WKU), or University of Louisville J. B. Speed School of Engineering (UofL) to obtain a bachelors of Science in Civil Engineering (BSCE) are eligible to apply. Students may also attend pre-engineering courses at Kentucky State University (KSU), Kentucky Community and Technical College System, or other Kentucky state colleges or universities, and then finish their Bachelors of Science in Civil Engineering at UK, WKU, or UofL. More info on the scholarship program.

There are many benefits to the KYTC scholarship including:

- Stipends that cover tuition

- Guaranteed summer internships during your college career

- A guaranteed job out of college

The debatable cost of receiving the aforementioned benefits is that for each year a student receives a stipend they are required to work a year at KYTC. There is an option to pay back the stipends monthly, but there is a 6% compounded interest rate applied to the loan. The interest can be avoided if the student pays the full amount of stipends given to them, as a lump sum, when they graduate. The cost to students is that there are other jobs that offer higher paying jobs than KYTC, thus there is an economic loss during the required years of service. Money is worth more in the present than in the future. So the question becomes, how much do I have to assume time is worth for the post-graduation cost (lost wages) to be worth less than the pre-graduation benefit (stipends)? In other words, looking through an economic lens, would a student be better off by taking a loan and working in the private sector than to have the scholarship?

Assumptions

This analysis only captures the benefit of receiving stipends. The summer internships are not required, so I am assuming students are not taking them. Also, the benefit of having a guaranteed job is tough to quantify. I am assuming that a student has another job already lined up for when they graduate. In other words, the summer internships and guaranteed job are icing on the cake. I am assuming that there are not any differences in benefits, working hours, taxes, essentially that the only difference between the jobs is their wages Many of my assumptions are aligned to put the scholarship behind the 8-ball. Doing so simulates a worst case scenario for the scholarship program to be better. In the case of concluding that a student is better off with the scholarship, the assumptions I chose will then help to prevent people from poking holes in the final conclusion.

The analysis is broken down into two assumed scenarios:

-

A student receives the scholarship their freshmen year, graduates with their bachelors degree in 4 years, receives their EIT II raise after two years of working, and finally finishes out their last two years of service required by the scholarship.

-

A student receives the scholarship their freshmen year, graduates with their masters degree in 5 years, receives their EIT II raise after two years of working, receives their TE I raise after two more years, and finally works off their last remaining year of service at KYTC.

These scenarios are rather fast-paced and may not represent a typical civil engineering student. The scenarios were chosen to again simulate a worst case scenario for the scholarship program. I won’t get to into detail yet, but know that if a student finishes their degree in a shorter amount of time, then the cost (loss wages) of this analysis is discounted less. The assumption of a student passing the required exams (FE and PE) and receiving promotions as soon as they are eligible are also made.

The wages of the alternative job is a major assumption of this analysis. PUMS data is used to find the average wages of a civil engineer with a bachelors degree that is working in Kentucky. So, I am assuming a student would stay within Kentucky. After processing the data to account for some surprise anomalies, the average wages is assumed to be $56,225. The only difference in the masters scenario is that I add a filter of having a masters, instead of bachelors. The average wages for the alternate job in the masters scenarios is assumed to be $62,369.

Data

Two data sources are used for this analysis. The first is my own information gained from being in the scholarship program, and the other is the PUMS data provided by the US census. My word is pretty much all I can provide to validate the former, but most of the information on wages for KYTC positions and the KYTC scholarship is available online. The PUMS data can be found here, and the WAGP field is used for wages. I had to filter the data, so that I was only averaging the wages of a civil engineer with a bachelors degree. There are many “occupation” fields within the PUMS dataset. However, the FOD1P field provided the most records and the most reasonable average wages. The civil engineering FOD1P code is 2406. The SCHL field is used to filter out the engineers that have a bachelors degree. The SCHL code for a bachelors degree is 21. Filtering by education prevents any overestimation by including the wages of engineers with graduate degrees. A similar process is completed for the masters scenario, with the only exception being the SCHL code 22 is used to filter out engineers with a masters degree. I had to clip both sets of wages by $1 and $100,000 to avoid anomalies in the data as well.

Method

The benefits and costs had to be converted to a present day value, so that they are all on a level playing field. In other words, to compare apples to apples. I chose the first year (freshmen year) as my present day. Benefits and costs after the base year have to be discounted before they can be compared. This means that the analysis is very sensitive to the rate that benefits and costs are discounted at. A range of effective interest rates are tested to see what rate needs to be assumed for a student to be better off having the scholarship. On one end is 0%, which assigns no value to time (not reasonable), and on the other is a 10% effective interest rate, which assigns an arguably high value of time (not likely). Equation 1 is used to discount the benefits and costs to a base year value.

Equation 1: P = F(1+i)^n

P = Present/Base year value

F = Future year value

i = effective interest rate

n = number of years the future year is from the base year

To see how well off a student is, a cumulative sum of the present value benefits and costs is made for each year. If the sum is greater than 0 at the required years of service, then the KYTC scholarship is considered to improve a student’s well-being.

Finally the fun part of the blog!!!

Results

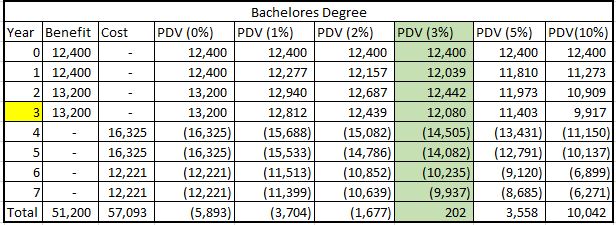

Now that we have all of the boring background out of the way, we can finally dig into the fun stuff. Table 1 shows, for each year, all of the benefits and costs and present values for each of the interest rates. Year 3 is highlighted because that is the year the student graduates. The 3% interest rate column in shaded green because that is lowest interest rate in which a student is better off by having the KYTC scholarship.

Table 1

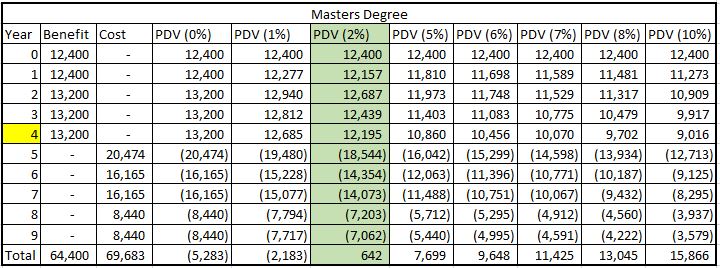

Table 2 shows the results for the masters scenario. The same things are highlighted and shaded, but the lowest interest rate is now 2%. This is due to the masters degree keeping a student from working an extra year, and supports the idea that the longer it takes a student to finish their requirements the better they are off to have the KTYC scholarship.

Table 2

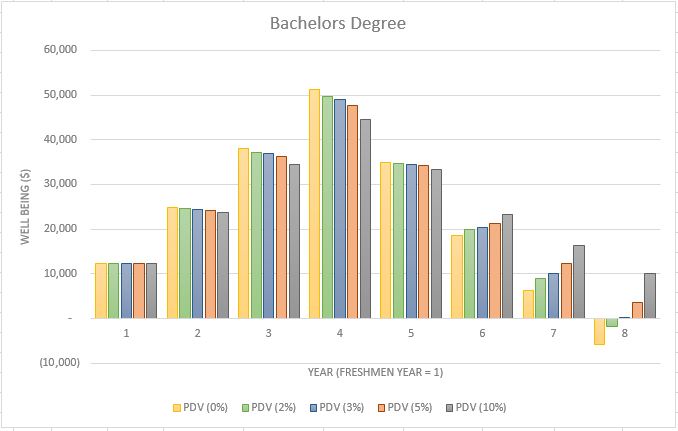

Figure 1 is a bar chart visualizing the cumulative summing process. The bars above zero mean that the scholarship improved a student’s well-being in that year, and vice versa for the ones below. Starting at interest rate 3%, a student is better off by having the KYTC scholarship.

Figure 1

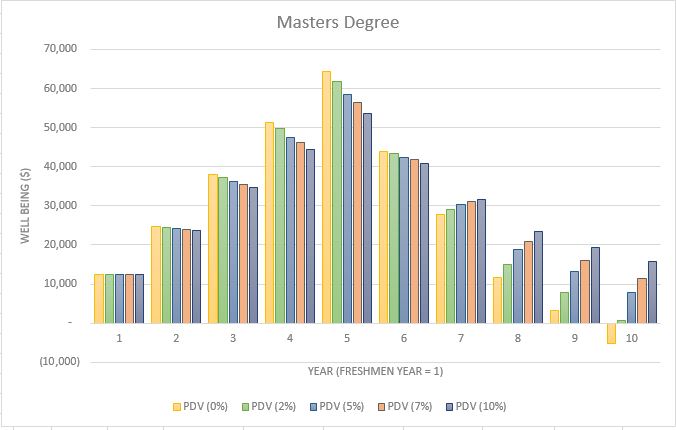

Figure 2 is another bar chart visualizing the cumulative summing process for the masters scenario. The same interpretation of the bars can be made, but now starting at interest rate 2%, a student is better off by having the KYTC scholarship.

Figure 2

Conclusion

The final interpretation of the results are that a 3% effective interest rate must be assumed for the KYTC scholarship to improve the well-being of all students. In other words, you must assume that I can invest my money and get back a 3% return on average. I will leave the validity of this assumption up to you, but of course I have to throw in my own opinion somewhere in here :). Inflation is not accounted for in the results, and it mostly bounces around 2%.Proof Inflation makes things costs more, which in turn will lower the value of money made in the future. In other words, the cost (lost wages) is reduced and the interest rate required for the scholarship to overall act as a benefit is reduced to 1%. Currently there is a 12 month IRA certificate at my bank that guarantees a 1.1% return.In case you’re interested! Let us not forget the benefits I left out of the equation. There is internships available during the summer while students are in college and you have the safety of a guaranteed job. As the saying goes, “a bird in hand is worth two in a bush.”